Chesnot/Getty Images

- Tech stocks fell Friday after China passed a strict law to protect people's data, adding to internet companies' compliance burden.

- The law is the latest move in Beijing's regulatory crackdown on the tech, education and other sectors.

- A Hong Kong index tracking Alibaba, Tencent and other tech companies slid as much as 4.5%

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

China's biggest tech stocks fell sharply Friday after the country's top legislature passed a data protection law that means companies will now need to comply with strict rules on collecting and handling people's information.

The Hang Seng Tech index, which tracks the 30 largest tech companies in Hong Kong including Tencent and Alibaba, dropped as much as 4.5% after state media reported the approval.

The Personal Information Protection Law passed by the National People's Congress is set to be implemented November 1, Chinese media outlet Xinhua reported.

Entertainment giant Tencent warned Thursday that China's regulatory crackdown on internet companies would continue. Beijing has acted to rein in publically traded companies, flexing its regulatory muscle against social-media companies, ride-hailing providers, financial services firms and other sectors, Jim Smigiel, chief investment officer at SEI Investments, said in a note.

"For investors, this can lead to declining portfolio values, as government intervention introduces uncertainty that can result in stock price volatility," he said.

The new law articulates for the first time a set of rules around better storage of user data and the conditions under which companies can collect data, including obtaining prior consent. There are also strict guidelines to safeguard Chinese citizens' data when it is transferred outside the country.

Businesses will be required to appoint a responsible employee to ensure compliance with the law.

While the second draft of the legislation was released in April, the final version has yet to be published, according to CNBC. An earlier draft states companies cannot refuse to provide services to people who object to having their data collected.

Chinese stocks listed in the US have been suffering under Beijing's regulatory pressure, with the added factor of action and risk warnings from the Securities and Exchange Commission.

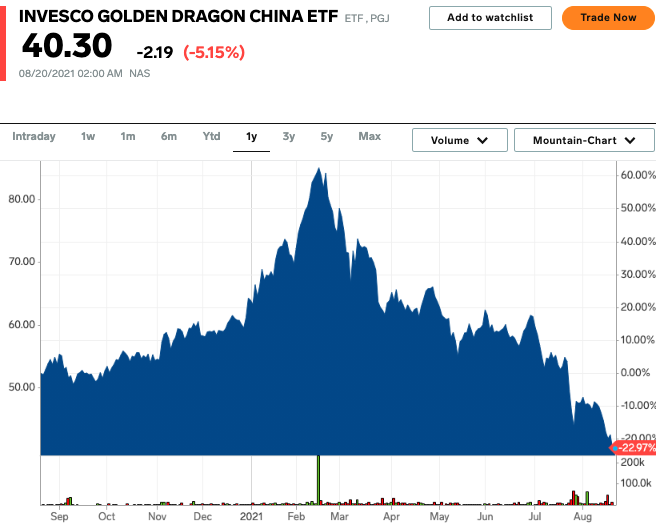

The Nasdaq Golden Dragon index, which tracks US-listed Chinese stocks, closed more than 5% lower on Thursday in New York, dragged by a 7% drop in Alibaba. The index is down almost 10% since Monday, which puts it on track for its biggest weekly drop in three months.

Beijing's regulatory crackdown on industries including technology, gaming, online education, and fintech, has pulled the index down almost 53% from its peak in February. China's richest titans including Jack Ma and Pinduoduo founder Colin Huang have lost billions from their personal wealth.